June 25, 2024

The prevalence of chronic diseases such as obesity, hypertension, and diabetes among adults underscores the importance of exercise and physical activity in managing these conditions. Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are valuable tools for managing healthcare expenses, yet many exercise professionals and their clients may not be aware of their potential for covering physical activity expenses under certain conditions. Many employers and employees are not yet aware of these benefits. It is essential to educate them about the potential tax advantages and the steps required to utilize these benefits effectively. This month’s CREP blog provides insights from important IRS guidance on how to use tax-advantaged saving accounts and what pitfalls to avoid.

Understanding Tax-Advantaged Saving and Spending Accounts

Health Savings Accounts (HSAs) are tax-advantaged accounts available to individuals enrolled in high-deductible health plans (HDHPs). Contributions are tax-deductible, the account grows tax-free, and withdrawals for qualified medical expenses are tax-free (1).

Flexible Spending Accounts (FSAs) are employer-established plans that allow employees to set aside pre-tax dollars for certain out-of-pocket healthcare costs. Unlike HSAs, FSAs typically have a "use-it-or-lose-it" rule, where funds must be used within the plan year or forfeited (2).

Qualifying Expenses

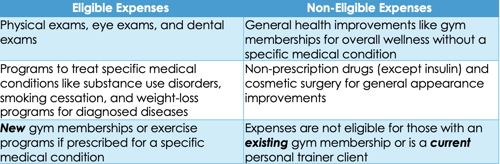

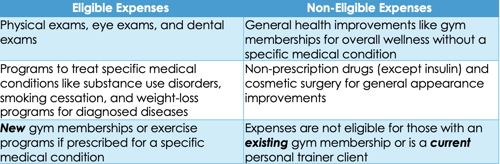

For an expense to qualify for reimbursement under an HSA or FSA, it must be directly related to the treatment of a diagnosed medical condition. IRS representatives emphasize that proper documentation and a legitimate medical diagnosis are crucial. For instance, gym memberships or exercise programs can be reimbursed if prescribed to treat specific medical conditions such as obesity, hypertension, or diabetes (3, 4, 5, 8).

Utilizing HSA/FSA for Physical Activity

Utilizing HSA/FSA for Physical Activity

Proper documentation is critically important. Exercise professionals should remind clients that the letter of medical necessity from a licensed healthcare provider must include: the patient's name, a specific diagnosis, the recommended treatment plan, the duration of the treatment, and the physician’s signature and date (5, 8).

Here’s how exercise professionals can guide their clients on utilizing their HSA/FSA for physical activity expenses:

- Medical Necessity: Ensure the client has a diagnosed medical condition that includes physical activity as part of the treatment, or management of that condition. Conditions like obesity, diabetes, or heart disease typically qualify.

- Letter of Medical Necessity: Help clients obtain a letter from their healthcare provider. This letter should include the patient and provider information, clearly state the diagnosis of disease or medical condition, the prescription for physical activity or exercise for treating the medical condition and the rationale for medical necessity any safety considerations, duration of prescription and the signature and credentials of the provider issuing the letter.

- Detailed Records: Advise clients to maintain detailed records, including receipts and the letter of medical necessity, to substantiate the medical expense if audited by the IRS.

Avoiding Pitfalls

Confusing general wellness with medical treatment can be a significant pitfall. Only expenses directly related to the treatment of a diagnosed medical condition are reimbursable, and general wellness activities do not qualify. Another critical issue is the misrepresentation of expenses. Exercise professionals should be cautious of companies that misrepresent wellness and general health expenses as medical care. The IRS warns against claims based solely on self-reported health information without proper medical diagnosis and documentation. Additionally, handling annual memberships requires attention. If clients pay for an annual gym membership, they can only claim the portion of the expense corresponding to the period during which the medical condition was diagnosed and the treatment was prescribed (5, 6, 7, 8).

Final Thoughts

Understanding how HSAs and FSAs can be used for exercise and physical activity expenses can greatly benefit clients with specific medical conditions. Exercise professionals should stay informed about IRS guidelines and help clients navigate the requirements to maximize their health benefits. Proper documentation and a clear understanding of what qualifies as a medical expense are essential to utilizing these benefits effectively and avoiding potential pitfalls. Exercise professionals can enhance the accessibility and affordability of necessary physical activity.

References

- Internal Revenue Service. (2024a). IRS alert: Beware of companies misrepresenting nutrition, wellness, and general health expenses as medical care for FSAs, HSAs, HRAs, and MSAs. https://www.irs.gov/newsroom/irs-alert-beware-of-companies-misrepresenting-nutrition-wellness-and-general-health-expenses-as-medical-care-for-fsas-hsas-hras-and-msas

- Internal Revenue Service. (2024b). Topic no. 502, Medical and dental expenses. https://www.irs.gov/taxtopics/tc502

- Internal Revenue Service. (2024c). Frequently asked questions about medical expenses related to nutrition, wellness, and general health. https://www.irs.gov/individuals/frequently-asked-questions-about-medical-expenses-related-to-nutrition-wellness-and-general-health

- Internal Revenue Service. (2024d). Publication 502: Medical and dental expenses. https://www.irs.gov/pub/irs-pdf/p502.pdf

- Internal Revenue Service. (2024e). Publication 969: Health savings accounts and other tax-favored health plans. https://www.irs.gov/pub/irs-pdf/p969.pdf

- Optum. (2024). When exercise is doctor-ordered, turn to your HSA/FSA. https://store.optum.com/blog/article/healthy-living/when-exercise-doctor-ordered-turn-your-hsafsa/

- Internal Revenue Service. (2024f). IRS addresses questions about medical expenses related to nutrition, wellness, and general health. https://www.irs.gov/newsroom/irs-addresses-questions-about-medical-expenses-related-to-nutrition-wellness-and-general-health

- Adams, T., Bantham, A., Goscinski, M., Joy, L., Knopf, K., Wei, A., & Whitsel, L. (2024). Using FSAs and HSAs to pay for physical activity expenses [Webinar]. Physical Activity Alliance. https://www.youtube.com/watch?v=8cvaTA8rrNM

Utilizing HSA/FSA for Physical Activity

Utilizing HSA/FSA for Physical Activity